RCAT Stock: A Deep Dive into Red Cat Holdings and Its Market Potential

Introduction to RCAT Stock

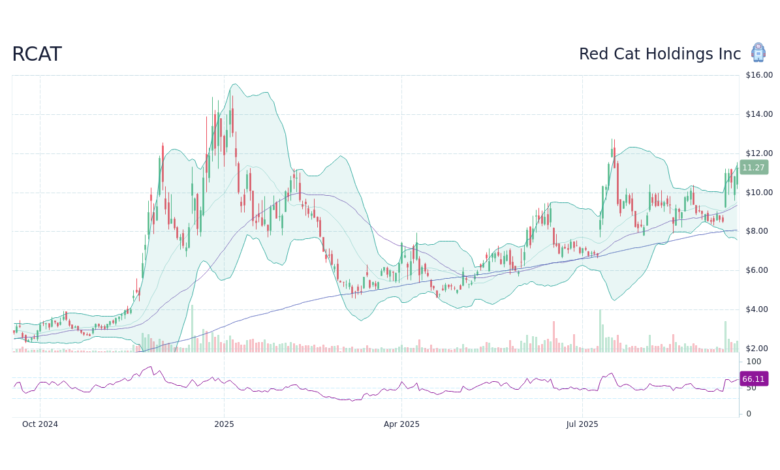

When investors search for RCAT stock, they are typically looking into the growth prospects and financial trajectory of Red Cat Holdings, a company positioned at the intersection of defense technology, drone innovation, and advanced unmanned systems. Over the past few years, RCAT has gained increasing attention from retail traders and institutional investors alike, particularly as global demand for military-grade drones and surveillance technology continues to expand.

In this in-depth article, we will explore RCAT stock from multiple angles—company background, financial performance, growth strategy, competitive landscape, risks, and long-term outlook. The goal is not just to provide surface-level information, but to offer expert-level insight in a clear, conversational tone that helps you truly understand what makes RCAT an intriguing (and sometimes volatile) investment.

Company Overview: Understanding Red Cat Holdings

Red Cat Holdings is a publicly traded company focused on providing advanced drone products and solutions, primarily for military and government applications. Unlike consumer-focused drone brands that cater to hobbyists, Red Cat has strategically positioned itself in defense, tactical operations, and government contracts. That positioning significantly shapes how RCAT stock behaves in the market.

One of Red Cat’s most recognized subsidiaries is Teal Drones, which designs and manufactures small unmanned aerial systems (sUAS) intended for military use. Teal Drones became particularly relevant when it gained traction within U.S. defense circles, especially as the U.S. government began prioritizing domestically manufactured drones over foreign-made alternatives.

The company has aligned itself closely with U.S. national security interests. This is important because defense spending tends to be less cyclical than consumer markets. Governments do not easily reduce military investments during economic downturns. That gives RCAT stock a somewhat different risk profile compared to many tech startups.

However, Red Cat is still relatively small compared to major defense contractors. It is not in the same category as industry giants like Lockheed Martin or Northrop Grumman. Instead, it operates in a niche segment focused on agile, rapidly deployable drone solutions. That smaller scale can mean higher growth potential—but also higher volatility.

The Drone Industry and Market Opportunity

To properly evaluate RCAT stock, you have to understand the industry it operates in. The global drone market has expanded rapidly over the last decade, moving far beyond recreational photography. Drones are now used in defense, logistics, agriculture, disaster response, and infrastructure inspection.

Defense remains one of the most lucrative segments. Military organizations increasingly rely on drones for reconnaissance, surveillance, intelligence gathering, and tactical operations. Small drones offer real-time battlefield awareness without putting soldiers at risk. That is a compelling value proposition in modern warfare.

Geopolitical tensions have also accelerated drone adoption. Conflicts around the world have demonstrated how critical unmanned systems are in modern combat strategy. As countries modernize their defense infrastructure, demand for domestically produced, secure drone systems has grown significantly. That trend directly benefits companies like Red Cat.

Importantly, U.S. legislation and defense procurement guidelines have shifted in favor of American-made drones. This regulatory environment provides a competitive advantage for U.S.-based manufacturers over foreign competitors. RCAT stock investors often cite this “policy tailwind” as a major long-term catalyst.

Financial Performance and Revenue Trends

RCAT stock is often described as a growth story rather than a value investment. The company has historically reinvested heavily into expansion, research, and acquisitions. As a result, profitability metrics have fluctuated, and net income has not always been consistent.

Revenue growth, however, is a critical metric to monitor. Over recent reporting periods, Red Cat has shown meaningful increases in top-line revenue, driven by government contracts and expanded production capabilities. Growth in defense contracts can create lumpier revenue streams, but when large orders are secured, they can significantly boost quarterly results.

One thing investors must understand is that small-cap defense companies can experience sharp revenue swings depending on contract timing. This makes RCAT stock more volatile around earnings announcements. A single contract award or delay can dramatically impact reported financials.

Balance sheet strength is another area of focus. Growth-stage companies often rely on equity offerings or debt financing to scale operations. That can lead to share dilution, which is something existing shareholders need to monitor carefully. While capital raises can fuel expansion, they can also pressure the stock price in the short term.

Government Contracts and Strategic Positioning

A major driver of RCAT stock performance is government contract activity. Defense contracts are often multi-year agreements, which provide revenue visibility once secured. However, the bidding process can be competitive and time-consuming.

Red Cat has positioned itself as a trusted supplier within U.S. defense ecosystems. Compliance with U.S. security requirements, cybersecurity standards, and supply chain transparency gives the company credibility in a highly regulated environment. This is not a space where new entrants can easily compete.

Winning key contracts can dramatically reshape investor sentiment. A high-profile contract announcement can send RCAT stock soaring, as markets price in future revenue growth. Conversely, failure to secure expected contracts can lead to sharp pullbacks.

The defense market also has high barriers to entry. Once a company becomes integrated into a military supply chain, it often develops long-term relationships. That stickiness can create recurring revenue opportunities, making government partnerships one of the strongest long-term pillars for RCAT.

Competitive Landscape and Industry Challenges

Although Red Cat operates in a promising sector, it is not without competition. Larger defense contractors have extensive resources, established supply chains, and strong lobbying power. While they may not focus exclusively on small drones, they can enter the space aggressively if they see opportunity.

International drone manufacturers also represent competition, though U.S. procurement policies have limited their access to certain government contracts. Still, global competitors may compete in commercial markets or in international defense sales.

Technology evolves rapidly in the drone industry. Companies must constantly innovate to improve battery life, payload capacity, software integration, and cybersecurity features. Falling behind technologically could quickly erode competitive advantage.

Supply chain disruptions are another concern. Components for drones—such as semiconductors and advanced sensors—can be subject to global shortages. Any production bottleneck can delay contract fulfillment, potentially impacting RCAT stock performance.

Risks Associated with RCAT Stock

Investing in RCAT stock carries several risks, particularly due to its small-cap status. Smaller companies tend to experience higher price volatility, lower liquidity, and greater sensitivity to news events.

Dependence on government contracts creates concentration risk. If defense budgets shift or if procurement priorities change, revenue streams could be affected. Political transitions can also influence defense spending priorities.

Dilution risk is another factor. Growth companies sometimes issue additional shares to raise capital. While this can strengthen the balance sheet, it can also reduce earnings per share for existing investors.

Finally, execution risk must be considered. Scaling manufacturing operations, meeting delivery timelines, and maintaining product quality are critical. Any operational misstep could impact both financial performance and investor confidence.

Long-Term Outlook and Growth Potential

The long-term thesis for RCAT stock centers on the continued expansion of drone adoption in defense and government sectors. As unmanned systems become more integral to national security strategies, demand for specialized drone manufacturers is expected to grow.

Red Cat’s strategic focus on military-grade drones differentiates it from consumer-focused brands. This specialization could allow the company to carve out a defensible niche in a rapidly expanding market.

If the company continues securing contracts and scaling production efficiently, revenue growth could accelerate significantly. In that scenario, RCAT stock could transition from a speculative growth play into a more established defense-sector investment.

However, long-term success depends on consistent execution, disciplined financial management, and ongoing innovation. Investors must weigh high growth potential against the inherent risks of small-cap defense technology companies.

Conclusion:

RCAT stock represents a compelling but volatile opportunity within the defense technology sector. Red Cat Holdings has aligned itself with powerful macro trends—rising defense spending, increased drone adoption, and regulatory support for domestic manufacturers.

For aggressive investors comfortable with risk, RCAT offers exposure to a niche yet rapidly expanding market. The company’s positioning within U.S. defense ecosystems provides potential for meaningful upside if contract wins continue.

At the same time, volatility, dilution risk, and operational challenges should not be ignored. RCAT is not a blue-chip defense giant—it is a growth-stage company navigating a competitive and capital-intensive industry.

In short, RCAT stock is not for the faint of heart. But for investors who understand the risks and believe in the long-term future of unmanned defense systems, it remains one of the more intriguing small-cap stocks to watch in the evolving drone economy.